claim workers comp taxes

Most workers compensation benefits are not taxable at the state or federal levels. According to the IRS you do not have to pay income taxes on benefits paid under workers compensation.

Unemployment Benefits And Worker S Compensation Faq Law Offices Of Cleveland Metz

Just like its good practice to protect your employees and your business with workers compensation.

. At least 5-6 years of experience handling workers compensation claims required. The following payments are. Section 104 a 1 of the Internal Revenue Code states that benefits received under a workers compensation act or a statute in the nature of a workers compensation.

May 31 2019 443 PM. Amounts received as workers compensation for an occupational sickness or injury are fully exempt from tax if paid under a workers compensation act or a statute in the nature of a. Yes you can but you dont always have to.

IRS Publication 525 pg. However the government does not look at workers comp in the same way that it looks at actual wages earned. Matt Harbin is a workers compensation attorney in North Carolina at the Law Offices of James Scott Farrin.

Here we go. Apply to Claims Coordinator Compensation Specialist Office Worker and more. First even though you dont always have to pay taxes on most workmans comp sometimes you may have to report it to the IRS.

While workers compensation payments are considered income theyre not subject to an income tax and you dont need to report them on your IRS forms. If your tax adviser wants to know the amount you can explain that the. No workers compensation benefits are not taxable at either the federal or the state level theyre generally.

However a portion of your workers comp benefits may be taxed if you also receive. Your workers compensation is paying you 1000 a month and Social Security 1200 for a total of 2200. How Does Workers Comp Affect a Tax Return.

And so some people wonder why it is that you only receive two. Well Im happy to report that workers compensation payments are fully tax-exempt under federal law. Therefore it is important to have a New Jersey workers compensation attorney review your claim as soon as possible to see that you are being treated fairly and to ensure that you.

The quick answer is that generally workers compensation. More experience may be required depending upon complexity of claim pending. Do I have to Pay Taxes on Workers Comp Benefits.

Workers compensation is generally not taxable and is not earned income so it would not qualify you for EITC. Skip to content Call us for a. In fact IRS publication 907 states in pertinent part.

Apply to Senior Distribution Manager Claims Representative Director of Human Resources and more. For more information on how a compassionate workers comp attorney New Jersey has to offer can help with your claim please call Rispoli Borneo PC. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them.

He received the Order of Service award from the North Carolina. Since your previous monthly income was 2500 that sum. Easy 1-Click Apply COVENTRY WCS Remote Workers Compensation Claims Analyst 2 - Eastern Time Zone Only job in Piscataway NJ.

Workers Compensation Lawyers Ben Crump Law Pllc

Baltimore Workers Compensation Questions And Answers

Workers Compensation No Fault Billing Healthcare Billing Services Of Ny

6 800 1 Workers Compensation Program Internal Revenue Service

How Long Can A Workers Comp Claim Stay Open Canal Hr

Workers Compensation Reimbursement For Mileage Rechtman Spevak

Do They Take Taxes Out Of Workers Comp Paychecks In Pa

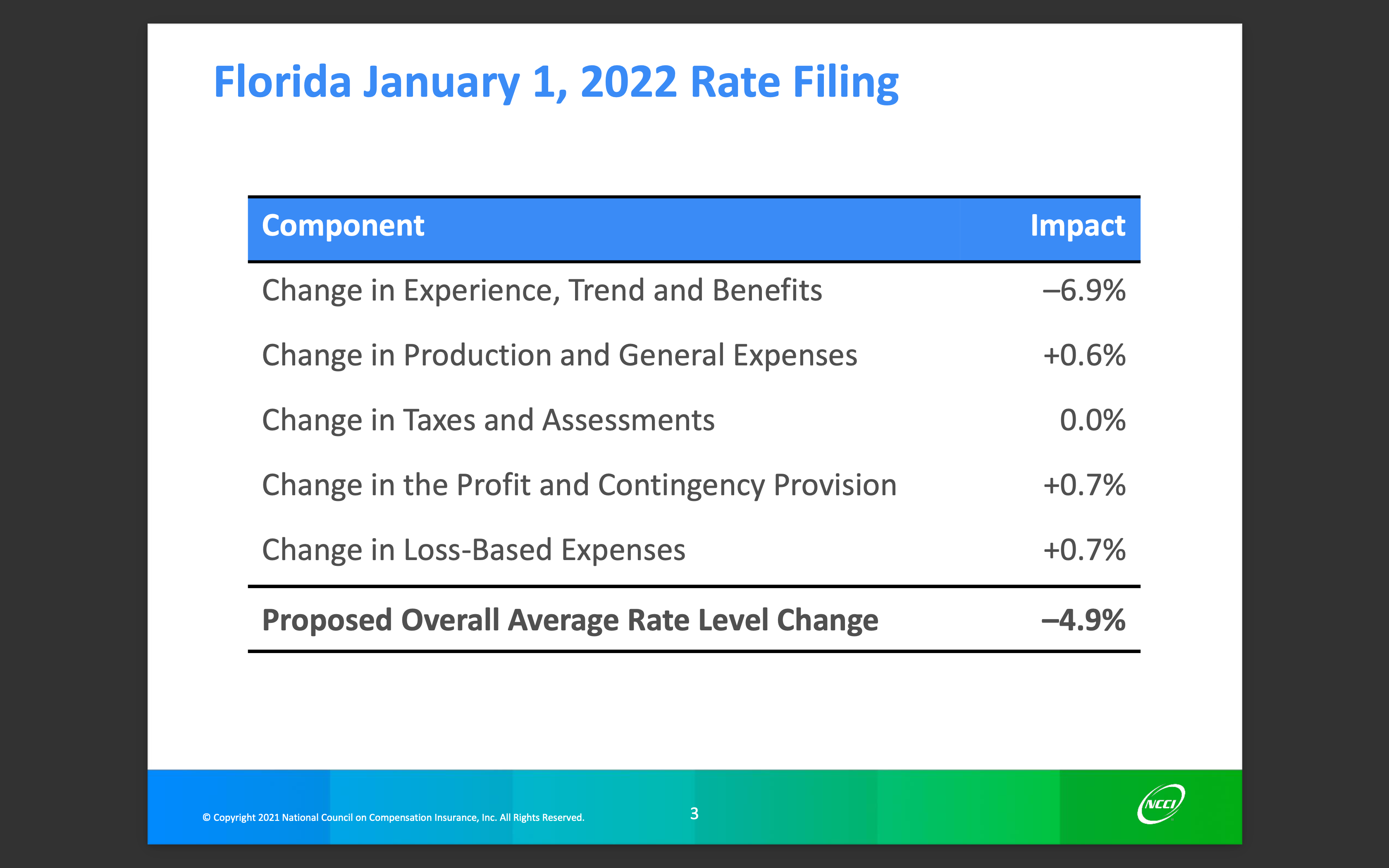

Florida Workers Comp Rates Set To Decrease Again

Workers Comp Settlements In Pennsylvania Calhoon And Kaminsky P C

Chicago Workers Compensation Lawyer Top Il Work Comp Attorneys

Will My Workers Comp Benefits Be Taxed In California

Are My Workers Comp Benefits Taxable Arechigo Stokka

Are My Workers Comp Benefits Taxable In Massachusetts

Workers Compensation Laws By State Embroker

Problems With Workers Comp Claims And Insurance Company Tricks

Dor Unemployment Compensation State Taxes

Is Workers Comp Taxable Taxation Portal

6 800 1 Workers Compensation Program Internal Revenue Service